The potential dangers of Global overspending and large class-wealth transfer

Inflation, Supply chain problems, and Unemployment are posing an increasing risk to the working class

Some economists, such as John B. Taylor, have asserted that the Fed was responsible, at least partially, for the United States housing bubble which occurred prior to the 2007 recession. They claim that the Fed kept interest rates too low following the 2001 recession. The housing bubble then led to the credit crunch.

Former Congressman Ron Paul (R) of Texas and his son Senator Rand Paul (R) of Kentucky have long attacked the Fed, arguing that it is hurting the economy by devaluing the dollar. They argue that its monetary policies cause booms and busts when the Fed creates too much or too little fiat money. Ron Paul's book End the Fed repeatedly points out that the Fed engages in money creation "out of thin air."He argued that interest rates should be set by market forces, not by the Federal Reserve. Paul argues that the booms, bubbles, and busts of the business cycle are caused by the Federal Reserve's actions.

How much is the U.S. in debt to China?

The United States currently owes China around $1.1 trillion as of 2021. China broke the trillion-dollar mark back in 2011 according to the U.S. Treasury report. However, China does not disclose how much debt the U.S. owes them.

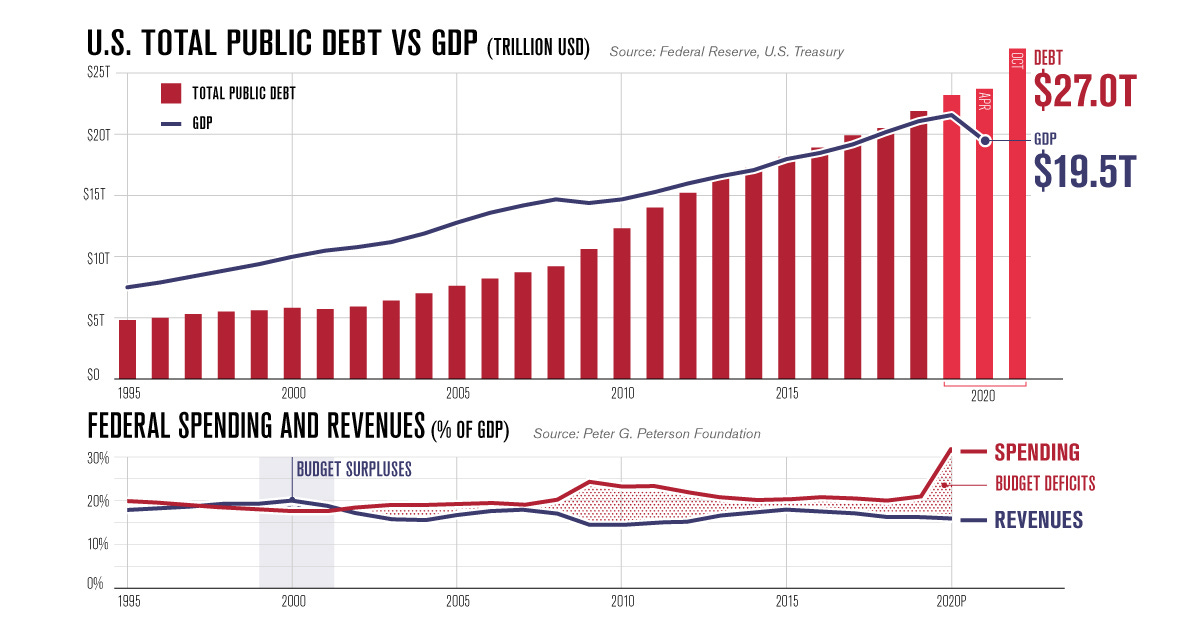

How much debt is the U.S. in 2021?

As of 2021, U.S. debt had surpassed $28 trillion.

Who does the United States owe the most debt to?

As of July 2020, Japan overtook China and became the largest foreign debt collector for the U.S. The United States currently owes Japan about $1.2 trillion according to the U.S. Treasury report.

In addition, the Pandemic has provided the biggest class-wealth transfer in history, with a whopping $ 3,7 Trillion losses of the working class and an increase of $ 3.9 Trillion seen for billionaires.

The Federal Response to COVID-19

In early 2020, the U.S. Congress appropriated funds in response to the COVID-19 pandemic. These funds were made possible through the Coronavirus Aid, Relief, and Economic Security (CARES) Act and other supplemental legislation. In March of 2021, additional funds were appropriated through the American Rescue Plan Act.

On a World-wide-scale: Governments respond with unprecedented spending: $10 trillion and counting, as of 2020. Here is a visual comparison of the bail-outs in 2008/ compared to now:

In addition to all of that, the IMF Governors Approved a Historic US$650 Billion SDR Allocation of Special Drawing Rights in August.

Washington, DC: The Board of Governors of the IMF has approved a general allocation of Special Drawing Rights (SDRs) equivalent to US$650 billion (about SDR 456 billion) on August 2, 2021, to boost global liquidity.

What does all this spending mean for current inflation numbers in the US?

CPI for all items rises 0.5% in July; shelter, energy, food, new vehicle indexes rise

08/11/2021

In July, the Consumer Price Index for All Urban Consumers rose 0.5 percent on a seasonally adjusted basis; rising 5.4 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.3 percent in July (SA); up 4.3 percent over the year (NSA).

Other concerns are broken supply chains and shipping impairments that affect the entire planet.

China partly shuttered the world’s third-busiest port after a single worker tested positive for COVID-19 on Wednesday, August 13th. The Meidong Terminal that closed processes 25% of the cargo that passes through the Ningbo-Zhoushan Port.

This comes in addition to what has now been referred to as “The Great American Labor Shortage” causing wary employers, desperate employers, and big incentives. My own yard irrigation technician recently told me about his biggest issues, running a small business:

Hard to obtain technical parts

Wars on small businesses, fighting with state and federal unemployment/ Pandemic money

Having to offer special incentives to find workers

smaller time commitments to work projects from potential employees

Some financial experts warn that the wealth transfer and desperation of the many unemployed, and now more impoverished of the population could be exploited by a planned Global Economy collapse through all this spending. Like Klaus Schwab, founder of the powerful, Switzerland-based World Economic Forum proclaims in his book, “The Great Reset”, Covid19 will be a tool to take down old economic structures and replace them with a new Global system. The system is said to have been planned out for 10 years or more, supposedly involving a Cash-less system. Indeed, the IMF writes about a Global Digital Currency system:

“Global satellite networks (Starlink, OneWeb, and others) are expected to provide widely accessible broadband services, including to lower-income countries, as soon as 2022. But a financial inclusion strategy cannot rely on a signal simply falling from the sky.

A synchronized infrastructure investment push is needed including broadening internet access to poorer and remote areas. In fact, when many countries act at the same time, public infrastructure investment can help lift growth domestically and abroad through trade linkages. These investments are necessary to support a viable digital payment strategy.

Clear legal frameworks are also essential. Central bank-issued digital currencies will likely require adaptation to central bank law and monetary law. “

https://www.imf.org/external/pubs/ft/fandd/2021/06/online/digital-money-new-era-adrian-mancini-griffoli.htm

The unspoken dangers of a Global, cashless financial control system:

-Governmental oppression and surveillance through a money-control-leash

-A potential Dictatorship, evolving through absolute power that corrupts absolutely

-Increasing Medical Tyranny “Use XY drug, in order to participate in society”, or your monetary access will be shut off

-Social Credit systems

-UBI dependant classes in society

To end the speculation about the future, I will include this video by an actual financial expert, Ernst Wolff, talking precisely about what is written in this article. I highly recommend watching his breakdown of where we are currently, and the road that led us here.

Let’s be optimistic that his final message of Hope at the end of the video will ring true.

-Tamicam